When a merger or acquisition is on the table, clear advice matters. In 2024, M&A deals involving U.S. companies totaled an incredible $7.2 trillion, making up more than half of all M&A activity around the globe, according to S&P Global Market Intelligence.

For business owners and real estate clients, it’s a clear sign that mergers and acquisitions are driving change and opportunity across the country, especially in South Florida.

At KEW Legal®, we know clients want answers they can trust and guidance they can actually use. That’s why our team is committed to breaking down even the most complicated deals into clear steps, explaining every option in plain English, and making sure you always feel heard.

Key Takeaways

- Mergers and acquisitions let companies grow, enter new markets, and gain a competitive edge.

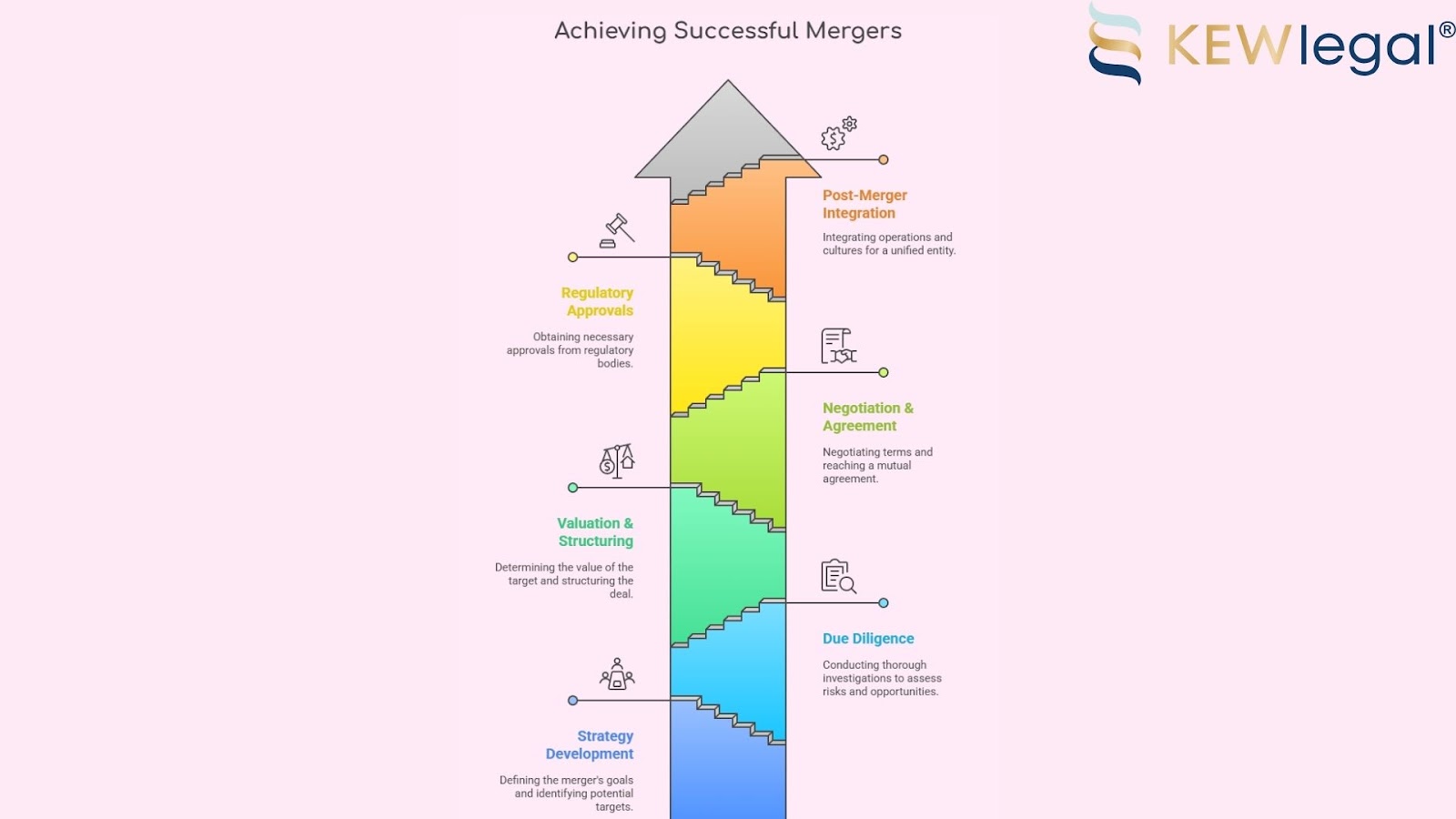

- The M&A process follows clear stages, from strategy and due diligence to integration after the deal.

- Each type of merger or acquisition serves a different goal and brings unique challenges and risks.

- Careful planning and honest assessment are essential for successful outcomes.

What Are Mergers and Acquisitions?

Mergers and acquisitions, or M&A, are ways companies join forces or buy each other to grow or gain a new edge. A merger means two companies agree to come together and form a new single company. An acquisition means one company buys most or all of another company’s shares and takes control.

How Do Mergers Differ from Acquisitions?

The difference between mergers and acquisitions is control. Mergers are usually friendly and equal, where both companies agree to join as partners. Acquisitions often involve one company buying another and making it part of its own business, sometimes with or without full agreement from both sides.

Why Do Companies Pursue M&A?

Companies use mergers and acquisitions to:

- Grow faster than they could alone

- Enter new markets or reach new customers

- Gain new products, services, or technology

- Lower costs by combining resources

- Eliminate competition

Top 5 Reasons for Mergers and Acquisitions

Here are the top reasons for a merger or acquisition:

- Access to new markets

- Cost savings through scale

- Increased market share

- New technology or talent

- Diversification of products or services

What Are the Key Stages of an M&A Transaction?

Mergers and acquisitions happen in clear stages. Each step is important for making sure the deal is a success. Based on data from Bain & Company, more than 60% of executives say poor due diligence is the main reason deals fall apart, showing how important it is to dig deep and check every detail before moving forward.

Stage 1: Strategy Development and Target Identification

Every M&A starts with a plan. Companies set goals for what they want to achieve, like entering a new market or gaining new skills. Then, they look for target businesses that fit these goals.

How Are Potential Targets Evaluated?

Potential targets are checked for size, financial health, reputation, culture, and whether they bring something new or valuable.

Stage 2: Due Diligence

Due diligence is a deep review of the target company. The buyer looks at financial records, legal matters, operations, customers, and employees. The goal is to spot risks and make sure there are no big surprises.

Financial, Legal, and Operational Due Diligence Checklist

- Review recent financial statements and tax returns

- Check for legal disputes or ongoing lawsuits

- Examine contracts, licenses, and key agreements

- Inspect customer lists and supplier relationships

- Assess staff, payroll, and benefits

Stage 3: Valuation and Deal Structuring

The buyer figures out what the company is worth using methods like market comparison, asset value, or projected earnings. The deal structure covers how the payment will work, whether cash, shares, or a mix.

Valuation Methods Compared

| Method | What It Means |

| Market Comparison | Value based on similar company sales |

| Asset-Based | Value based on total assets minus debt |

| Earnings Multiples | Value based on profit or cash flow |

Stage 4: Negotiation and Agreement

Both sides agree on the price and terms. They sign documents that outline what each will do, including timing, payment, and any special promises.

Key Terms and Legal Documentation

Key documents include the Letter of Intent (LOI), purchase agreement, and any side agreements on staff or business plans.

Stage 5: Regulatory Approvals and Closing

Some deals need approval from government bodies. Once everything is cleared, the deal closes, and ownership officially changes.

Stage 6: Post-Merger Integration

After closing, the companies work to join their teams, systems, and cultures. Integration is where many deals succeed or fail, depending on how smoothly everything comes together.

Integrating Teams, Systems, and Cultures

- Align leadership and announce changes to employees

- Combine business processes and IT systems

- Merge customer and supplier relationships

- Set new goals and performance measures

- Address cultural differences and support staff transition

What Are the Main Types of Mergers and Acquisitions?

Not all M&A deals look the same. According to Bain’s 2024 industry report, 59% of large U.S. strategic deals last year were “scale acquisitions”, where companies expand within an existing market. This focus on growth shows how many businesses use M&A as a way to strengthen their position close to home, including in regions like South Florida.

Horizontal, Vertical, Conglomerate, and Market-Extension M&A

- Horizontal merger or acquisition: Two companies in the same industry and at the same stage combine.

- Vertical merger or acquisition: Companies at different stages of production or supply chain come together, like a manufacturer buying its supplier.

- Conglomerate: Businesses from unrelated industries merge. This is usually done to diversify and spread risk.

- Market-extension merger or acquisition: Companies in the same industry but in different markets join forces to access more customers.

Friendly vs. Hostile Takeovers: What’s the Difference?

A friendly takeover happens when the company being bought agrees to the deal. Both sides negotiate terms and work together.A hostile takeover occurs when the buyer goes directly to the shareholders or fights the management to gain control, often without support from the company’s leadership.

Each type of M&A affects employees, customers, and markets in unique ways. The best choice depends on a company’s strategy and long-term plans.

What Are the Benefits and Risks of Mergers and Acquisitions?

M&A can bring major benefits. Companies that do frequent acquisitions deliver 130% higher returns to their shareholders compared to those that rarely make deals, as reported by Bain’s 20-year analysis. The risks are real, but the upside for those with a smart strategy is clear.

What Are the Advantages of Mergers and Acquisitions?

The main benefits of M&A include:

- Fast business growth

- Access to new markets and customers

- More products, services, or technology

- Stronger market position

- Lower operating costs through shared resources

5 Key Benefits of Successful M&A

- Growth without starting from scratch

- Quick entry into new regions or industries

- Combining strengths to beat competitors

- More talent and new ideas in the team

- Increased buying power and lower costs

What Are the Most Common Risks of Mergers and Acquisitions?

The biggest risks in M&A are:

- Culture clashes and loss of key staff

- Overestimating synergies or cost savings

- Legal or regulatory problems

- Missed goals due to poor planning or integration

- Paying too much for the target company

Top 5 Risks in M&A

- Failure to merge cultures

- Underestimating integration costs

- Overpaying for the deal

- Losing customers or talent

- Facing unexpected legal issues

How Is M&A Success Measured?

Success in mergers and acquisitions depends on hitting clear business goals. Today, nearly 70% of mergers are considered successful, according to research cited by Harvard Business Review. This big improvement shows that, with the right approach, M&A can truly pay off.

Key Performance Indicators (KPIs) for M&A

The following key performance indicators can help to measure success:

- Revenue growth after the deal

- Cost savings and improved profit margins

- Market share gained

- Customer and employee retention rates

- Achievement of synergy targets

These indicators show if the combined business is stronger and more valuable than before.

What Are Common Challenges and How Can They Be Overcome?

Integration after a deal closes remains one of the toughest hurdles.

Culture Clashes and Integration Pitfalls

Different work cultures can lead to confusion, mistrust, or loss of top talent. If teams don’t blend well, the new company may struggle to function as one unit.

The solution is early communication, leadership alignment, and involving staff in the integration process.

Legal and Regulatory Hurdles

Some deals are slowed down or blocked by legal issues or government reviews. Missing a key rule can mean costly delays or even canceling the deal. Getting legal advice and planning ahead often reduces these risks.

Financing and Valuation Challenges

Finding the right price is hard. Overpaying puts pressure on the new business to perform. Securing funding at fair terms is also tough, especially in uncertain markets.

Honest financial review and outside valuation professionals can help set a realistic price and avoid regret.

Frequently Asked Questions

How Long Does an M&A Transaction Take?

Most mergers and acquisitions take between six months and a year. Complicated deals or regulatory reviews can stretch the process longer.

What Does Due Diligence Involve?

Due diligence means closely checking the target company’s finances, legal standing, contracts, customers, and employees. The goal is to find risks, debts, or hidden problems before the deal is final.

How Can You Tell If an M&A Will Succeed?

Signs of success include clear goals, honest planning, strong leadership, and a good cultural fit between companies. Hitting financial targets and keeping key people on board are also good signs.

Move Forward with Confidence in Your M&A Journey

Making the right moves in mergers and acquisitions comes down to having a legal team that’s both experienced and truly invested in your goals. KEW Legal® brings you the clarity, practical support, and personal attention you need every step of the way, so you’re never left guessing about your options or your next steps.

If you’re ready to make smart, confident decisions for your business or real estate future, connect with our team today. Visit our contact page for straightforward answers, personalized guidance, and a partner who puts your interests first.