To protect your business from future conflicts and legal gray areas, every LLC should start with a clear operating agreement, even if it’s not required by your state. This document is the legal backbone that defines ownership, responsibilities, and what happens if things change or go wrong.

According to a 2025 Small Business Report conducted by The Zebra, 36% to 53% of small businesses are sued each year, reflecting the importance of having an operating agreement to avoid legal disputes.

At KEW Legal®, we focus on helping business owners turn legal uncertainty into confidence. Our team breaks down complicated documents into plain-language strategies that align with your goals, not just legal theory. We make sure your operating agreement supports your business now and scales with it later.

Key Takeaways:

- An LLC operating agreement is necessary for defining ownership, responsibilities, and procedures, helping avoid legal disputes.

- This agreement protects liability status, outlines profit distribution and decision-making, and must be updated as your business structure or members change.

- Relying on generic templates or failing to include key clauses like exit terms and voting rights can lead to costly mistakes, making legal review and customization highly advisable.

What Is an LLC Operating Agreement?

An LLC operating agreement is a foundational document that outlines how your limited liability company will be run.

It sets the rules for everything from ownership shares to daily operations to what happens if a member wants to leave. Think of it as the “user manual” for your business, spelling out the decisions, roles, and rights that keep things clear for everyone involved.

While some states don’t legally require one, having an operating agreement is still highly recommended.

This document is especially important for multi-member LLCs, but even single-member LLCs benefit by reinforcing the separation between personal and business assets, an essential part of liability protection.

Why Do You Need an Operating Agreement?

Running an LLC without a formal agreement opens the door to ambiguity in ownership, authority, and profit distribution, often leading to costly disputes or stalemates.

For example, imagine two business partners assume they’ll split profits 70/30 based on investment, but nothing is written down. If things go south, courts may default to a 50/50 division under state law, regardless of what was “understood.”

An operating agreement removes this kind of guesswork. It defines how decisions are made, what happens if someone exits, and how profits are handled. This is especially vital if your LLC has multiple members, outside investors, or complicated ownership structures.

Even for solo owners, it reinforces your limited liability status. It helps prove that your business is separate from you personally, a key point if you ever face legal claims or audits.

What Should Be Included in an Operating Agreement?

A good operating agreement spells out how your LLC runs and who’s responsible for what. It helps prevent future arguments and keeps everyone on the same page.

Here’s what to include:

- Ownership: Who owns what percentage.

- Contributions: How much money or assets each member put in.

- Distributions: How profits (and losses) are split.

Key Clauses

- Voting: Who votes on what, and how votes are counted.

- Exit Terms: What happens if someone leaves or passes away.

- Dissolution: What to do if the business closes.

When Is an Operating Agreement Required or Advisable?

In Florida, you’re not legally required to have a written operating agreement, but it’s still strongly advised. If you don’t have one, your LLC defaults to Florida’s standard rules, which may not match your intentions. For example, voting rights and profit splits could default to equal shares, even if your contributions differ.

You need an operating agreement when:

- You have more than one member

- You’re taking on investors or partners

- You want to protect personal assets

- You plan to open a business bank account

Even for single-member LLCs, a written agreement shows banks, courts, and the IRS that your business is real, and that’s key for protecting your personal assets.

How Do You Create or Update an Operating Agreement?

You’ve got two options: use a template or get legal help. Just know that templates can’t cover everything.

If your LLC is simple and has one owner, a free template might work, as long as you fill it out carefully. But once you add partners, money, or growth plans, things get complicated. That’s when a lawyer makes a big difference.

Without a custom agreement, your LLC defaults to state rules. These often assume equal ownership and profit splits, even if that’s not what you want.

Here’s how to do it right:

- Start with a template to outline basic terms.

- Get a legal review to catch mistakes and tailor it to your needs.

- Update it whenever you add members, change roles, or restructure the business.

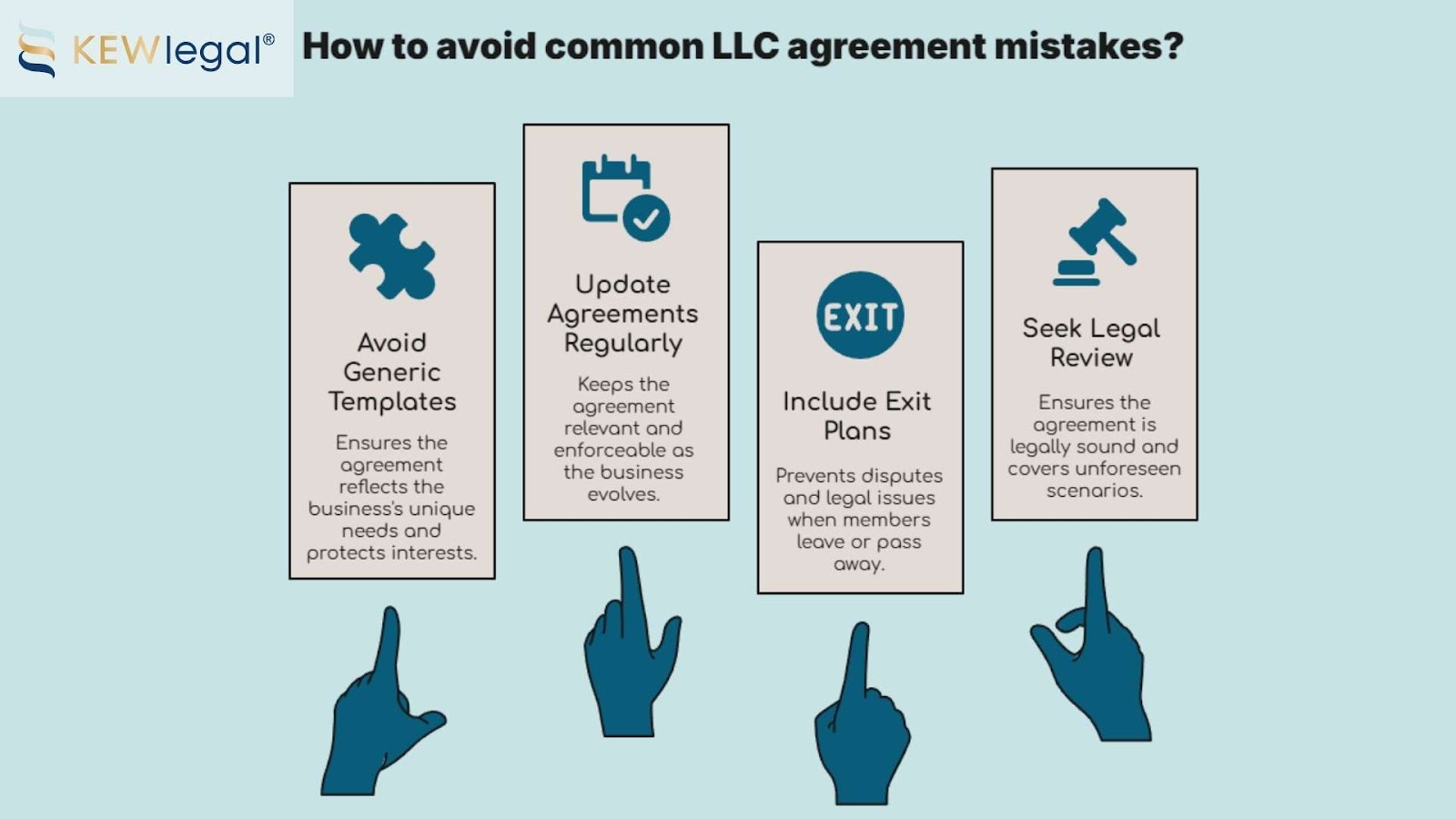

4 Common Mistakes to Avoid

Here are the biggest mistakes business owners make:

- Using Generic Templates

Free online templates might seem easy, but most are one-size-fits-all. They rarely reflect how your business actually works. You risk missing key clauses or agreeing to terms that don’t protect you. - Not Updating the Agreement

Your business will grow and change. If you add members, take on funding, or shift roles, your agreement needs to change too. Leaving it outdated can create confusion, or even make it unenforceable. - Leaving Out Exit Plans

What happens if someone wants to leave the business, passes away, or stops contributing? Without clear rules for buyouts or exits, you could end up in court. - Ignoring Legal Review

Even a solid draft can fall short if it’s not legally sound. A quick review by an attorney helps make sure your agreement holds up and covers the scenarios you haven’t thought of.

Avoiding these mistakes gives your LLC a strong foundation and helps you avoid disputes, delays, or legal headaches.

Get Help from Legal Professionals

Creating a clear, effective operating agreement doesn’t have to be complicated, but it should be done right. It’s a legal tool that protects your business, your partners, and your peace of mind.

At KEW Legal®, we review, draft, and update operating agreements that match your real-world goals, not just legal checklists. We explain every term in plain language, make sure the document aligns with Florida law, and customize it so it actually protects you in the situations that matter most.

Want peace of mind and a solid agreement? Contact KEW Legal® today to get started with a legal team that puts your business first.