Buying a business gives you a head start, but only if you know what to look for and how to protect yourself.

According to Statista, the value of global M&A deals worldwide amounted to 2.6 trillion U.S. dollars in 2024, with the United States being the most dynamic market and accounting for more than half of the total.

At KEW Legal®, we help clients make smart, confident decisions with clear legal guidance that saves time and avoids costly mistakes. We’ll help you buy an existing business, step by step, without the noise.

Key Takeaways

- Buying an existing business offers a faster, lower-risk path to ownership by leveraging established systems, customers, and cash flow.

- Proper valuation and due diligence are necessary to avoid overpaying or inheriting hidden financial or legal issues.

- There are multiple funding options available, including SBA loans, seller financing, and investor support, that make acquisition accessible to first-time buyers.

- Legal guidance during negotiations and agreement drafting helps protect your investment and allows for a secure transition.

Buying vs. Starting a Business

Buying or acquiring a business gives you a head start. You’re walking into something that’s already built, including customers, systems, revenue, maybe even a team. Starting fresh means doing all of that from zero.

Why Buying an Existing Business Can Be Smarter

Starting your own business sounds exciting, but it’s also unpredictable. You’ll need to test your idea, build a customer base, figure out operations, and probably lose money before you make any. With an existing business, much of that heavy lifting is already done.

Here’s what you’re getting when you buy:

- A real customer base, no need to chase your first sale.

- Proven products or services that people are already paying for.

- Staff who know how the business runs.

- Systems, suppliers, tools, and software that are already in place.

- Immediate cash flow, in many cases, revenue comes in from day one.

Trade-Offs of Buying an Existing Business

Even though buying a business can save time and lower risk, it’s not a sure thing. Some businesses are for sale for good reasons, and some are not.

Here’s what can make things tricky:

- You could overpay if you don’t know how to value the business.

- The seller might hide problems in the books or operations.

- It can take time to learn the ropes, especially if the seller doesn’t help with the transition.

- If employees or customers are loyal to the owner, change can cause friction.

Which One is Right for You?

If you like creating something from scratch and don’t mind risk, starting a business might suit you. But if you want momentum, structure, and less guesswork, buying or acquiring an existing business might be your faster, safer path to entrepreneurship.

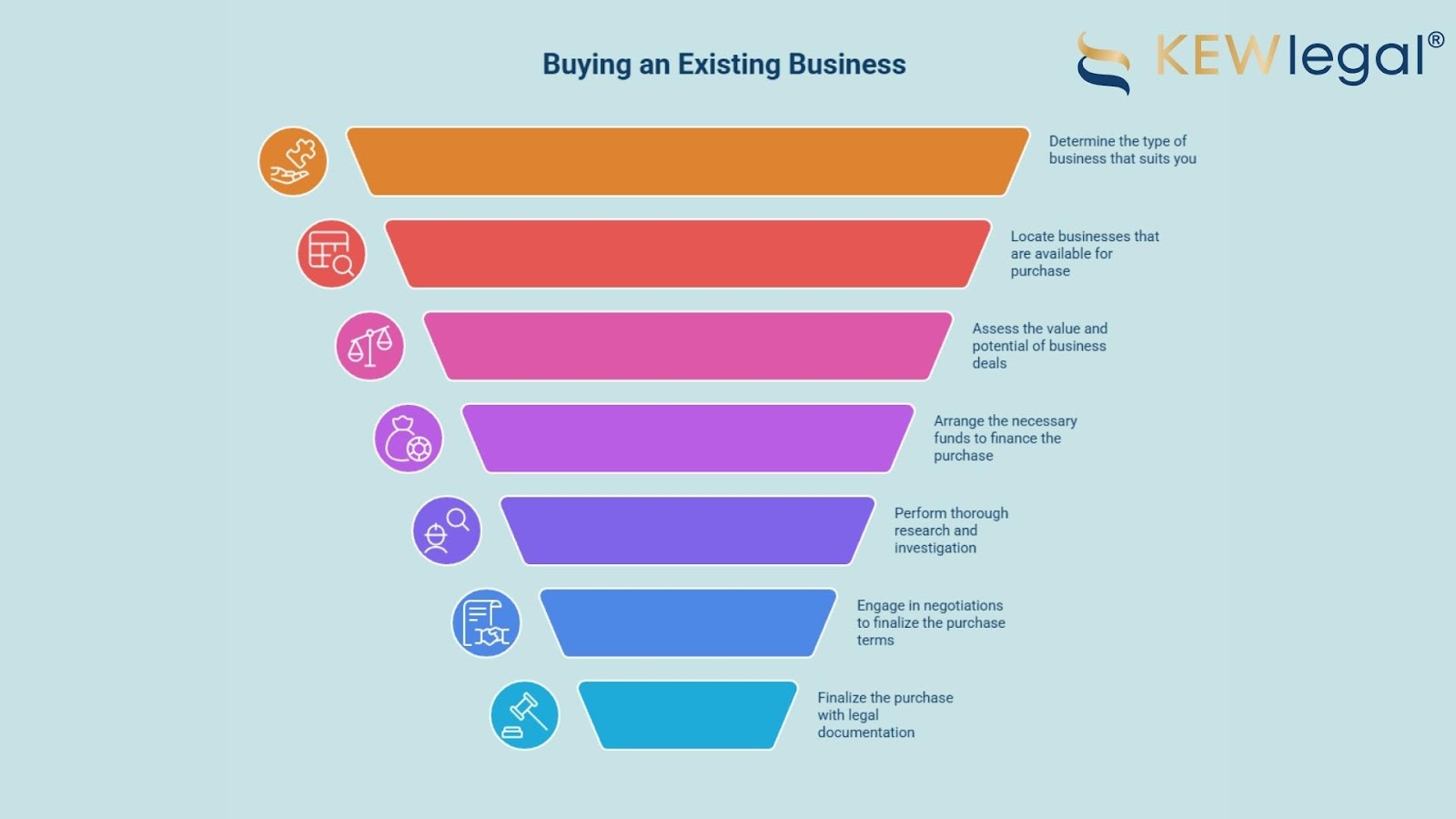

8 Steps to Buy an Existing Business

Here are the steps to buying or acquiring a business.

1. Understand What Kind of Business Suits You

Not every business is right for you, and that’s okay. Start with your strengths.

Ask yourself:

- Do I want something hands-on or something I can manage from a distance?

- Am I looking for a local business or something online?

- What industries do I understand (or want to learn)?

- Do I want a solo operation or a business with employees?

The goal here isn’t just finding a “profitable” business. It’s finding one that fits your lifestyle, skillset, and risk tolerance.

2. Find Businesses That Are Actually for Sale

Once you know what you want, you’ll need to find it. Here’s where people usually look:

- Online marketplaces: Sites like BizBuySell, Flippa, and BusinessBroker.net

- Business brokers: These are like real estate agents for businesses, they bring buyers and sellers together.

- Your local network: You’d be surprised how many businesses change hands through word of mouth.

- Franchise resale platforms: For those looking for structure with a twist.

3. Know How to Spot a Good Deal (And a Bad One)

Here’s what to look for once you’ve focused in on a business:

- Clean financials: Can you see consistent profit, not just revenue?

- Owner involvement: If the owner is the business, that could be a problem when they leave.

- Customer loyalty: Do people come back, or is it all one-time sales?

- Growth potential: Can you make it better, or is it already maxed out?

- Reason for selling: Is the owner retiring, or running from a sinking ship?

4. Figure Out How You’ll Pay for It

If you have cash, great. But many first-time buyers don’t, and that’s normal. Here are options to look into:

- SBA loans: Backed by the U.S. government and designed for small business buyers.

- Seller financing: The current owner lets you pay part of the price over time.

- Bank loans or credit unions

- Friends, family, or investors

- Personal savings or retirement funds (with caution)

5. Do Your Due Diligence

This step is where the deal is either solidified or falls apart. Based on data from Forbes, 50% of business purchases collapse during due diligence, usually because of undisclosed issues. This makes a thorough review of finances, contracts, and operational details necessary before moving forward. You’ll want to review:

- Tax returns

- Profit and loss statements

- Legal issues or pending lawsuits

- Contracts, leases, and employee records

- Inventory, equipment, and assets

6. Negotiate Like an Owner, Not a Shopper

Once you know the numbers, it’s time to talk about price and terms. Make sure to solidify:

- What’s included (inventory, equipment, brand, customer list)?

- How and when payments happen

- Whether the seller will stick around to help during the handoff

7. Sign the Agreement With a Lawyer

You’ve agreed on terms. Now it’s time to make it official.

Legal support might seem like an extra cost, but it’s often the best investment in the deal and can help to avoid more costly mistakes down the road.

8. Take Over Smoothly

You’re now the owner, congrats. But don’t change everything on day one. Once you own the business, ask the seller to:

- Stay on for 30–90 days

- Introduce you to customers, vendors, and employees

- Help you understand the systems and tools they use

Why Hiring a Business Lawyer is a Good Idea

Acquiring a business means contracts, negotiations, licenses, liabilities, and a lot of other elements can go sideways if you’re not careful. You don’t need a lawyer for every little thing, but you definitely want one when it counts.

They Know What to Look For

Even if you’re detail-oriented, business sale documents aren’t exactly light reading. A lawyer can:

- Spot vague or risky contract language

- Make sure the seller isn’t sneaking in liabilities

- Flag any red flags in lease agreements, vendor contracts, or customer deals

- Make sure you’re not assuming debts you didn’t agree to take on

They Help You Structure the Deal the Right Way

There’s more than one way to buy a business. You can:

- Buy the assets (equipment, customer list, brand, etc.)

- Buy the whole company, including its legal structure

Each option has different tax and legal consequences. A lawyer can explain the pros and cons based on your situation, so you don’t accidentally take on more risk than you meant to.

They Make Sure You Are Covered After the Deal

What happens if:

- The seller promised something that wasn’t true?

- An unpaid bill from last year shows up under your name?

- A vendor tries to back out of their contract?

A solid purchase agreement protects you after you take over, not just during the deal. Lawyers know how to build in those protections, especially for first-time buyers who may not know what to ask for.

How Much Does a Business Lawyer Cost?

Rates vary, but expect somewhere between $200 and $500 per hour, or a flat fee depending on the deal size.

When You Should Bring Them In

Don’t wait until the final hour. Ideally, a lawyer should step in after you’ve found a business you’re serious about, but before you sign anything binding.

Here’s when they’re most helpful:

- Reviewing the letter of intent (LOI)

- Drafting or checking the purchase agreement

- Helping with lease transfers, NDAs, and escrow terms

- Coordinating with your accountant or lender

3 Common Ways to Value a Business

Valuing a business is part art, part math. According to The SMB Center, the median asking price for a small business in the U.S. is around $250,000. If you’re looking at asset-based valuation, earnings multiples, or market comparisons, that figure gives you a useful benchmark to start with.

Most valuations fall into three buckets:

1. Asset-Based Valuation

This method calculates a business’s value by subtracting liabilities from the total value of its assets. It works well for companies with significant physical assets like inventory, equipment, or property. It’s less effective for service-based businesses, where value often lies in brand, relationships, or intellectual property.

2. Earnings Multiple

This approach multiplies the business’s annual net profit by an industry-standard number, typically between 2x and 4x. It’s commonly used for profitable businesses with steady earnings. Buyers should verify profit figures carefully, as sellers may exclude key costs or inflate performance.

3. Market Comparison

This method estimates value based on what similar businesses have sold for recently. It’s useful when data is available, especially for common industries or franchises. Its accuracy depends on having reliable comparables, which can be difficult to find.

Other Things That Can Affect Price

Valuation isn’t always based on numbers. Some things raise or lower the price even if the profit looks steady:

- Industry trends – Growing industries usually demand higher prices.

- Owner involvement – If the business depends heavily on the current owner, that’s a risk for you.

- Customer base – Loyal, repeat customers are a good sign.

- Staff – Are there experienced employees who’ll stick around?

- Reputation – Online reviews, brand trust, and SEO presence matter.

- Scalability – If you can grow it easily, that adds value.

How to Spot an Overpriced Business

If you’re not sure whether the asking price is realistic, check for these signs:

- Vague or missing financial records

- Huge recent jump in revenue (could be temporary)

- No real explanation for why the business is for sale

- Over-reliance on the owner’s personal relationships or skills

- No growth plan, or maxed-out market

Business Acquisition Financing Options

Most buyers don’t pay for a business out of pocket. If you don’t have large cash reserves, there are several financing options available, many requiring little upfront capital.

SBA Loans

A popular option backed by the government but issued through banks.

Pros:

- Up to 90% financing

- Low down payments, long terms (up to 10 years)

- Competitive rates

Requirements:

- Strong credit (680+)

- Solid business financials (at least 2 years)

- Business plan and documentation

- Slow approval process (can take weeks)

Seller Financing

The seller lets you pay part of the price over time.

How it works:

- You pay a portion up front

- Pay the rest monthly with interest

Pros:

- Easier approval

- Often more flexible

- Can be combined with other funding

Traditional Bank Loans

Issued directly by banks or credit unions.

What they assess:

- Your credit

- Business performance

- Your industry experience

Expect higher down payments and stricter terms than SBA loans.

Friends, Family, or Investors

Borrow from people you know or offer equity to private investors.

Considerations:

- Put all agreements in writing

- Define repayment or ownership terms clearly

- Separate business and personal funds

Personal Funds or Retirement Savings

Using savings or rolling over retirement accounts (e.g., 401(k)).

Considerations:

- Maintain a personal financial cushion

- Know tax implications

- Understand the risk

Combining Funding Sources

Many buyers blend multiple options. Examples include:

- SBA loan + seller financing

- Bank loan + personal savings

- Investor + SBA loan

What to Look for Before Buying a Business

Make sure to review the following before buying:

Financials

- Tax returns (last 3 years)

- Profit & loss statements

- Balance sheets

- Cash flow reports

- Accounts receivable/payable

Legal

- Business licenses and permits

- Contracts (customers, suppliers, employees)

- Existing or pending lawsuits

- Intellectual property rights

Operations

- Employee list, roles, and compensation

- Lease agreements

- Equipment and inventory lists

- Vendor and service provider info

Reputation

- Customer reviews

- BBB or regulatory complaints

- Online presence and SEO performance

Key Red Flags

- Inconsistent or missing financial records

- Heavy reliance on one customer or one employee

- Unexplained drops in revenue or rising expenses

- Undisclosed debts or legal disputes

- The owner is unwilling to provide documentation

Make Your Business Purchase the Smart Way

Buying a business comes with big decisions, and the right legal support makes all the difference. KEW Legal® gives you clear, practical guidance that protects your interests without slowing you down. If you’re serious about making a confident, informed purchase, we’re here to help you move forward.

Contact us now to get started.