Business compliance means making sure your company follows all the rules that apply to it, from licenses and taxes to employee rights and data protection. Staying compliant builds trust with clients, keeps operations running smoothly, and protects your business’s future.

At KEW Legal®, we do more than translate code into checklists. We help you turn legal vagueness into a competitive advantage. Our team blends deep legal knowledge with practical business insight, so you’re not just staying compliant, you’re building smarter, stronger operations.

Key Takeaways

- Business compliance is necessary for legal protection, growth, and client trust.

- Common compliance categories include finance, employment, data, licensing, and industry rules.

- Regular audits and proactive updates can reduce risk significantly.

- KEW Legal® offers responsive, business-savvy legal counsel tailored to your operations.

What Does Business Compliance Mean?

Business compliance refers to the process by which a company makes sure it adheres to all external laws, regulations, and internal policies relevant to its operations. It spans everything from local licensing to federal labor standards and industry-specific rules. Think of it as the legal hygiene that keeps a business healthy, respected, and operational.

Why Compliance Is Important for Every Business

Failing to comply with applicable laws can lead to fines, lawsuits, shutdowns, or damaged reputations. But compliance also creates strategic benefits. According to Zluri, 83% of compliance professionals say legal adherence is necessary in business decision-making. Proper compliance enhances trust with partners and customers and supports long-term scalability.

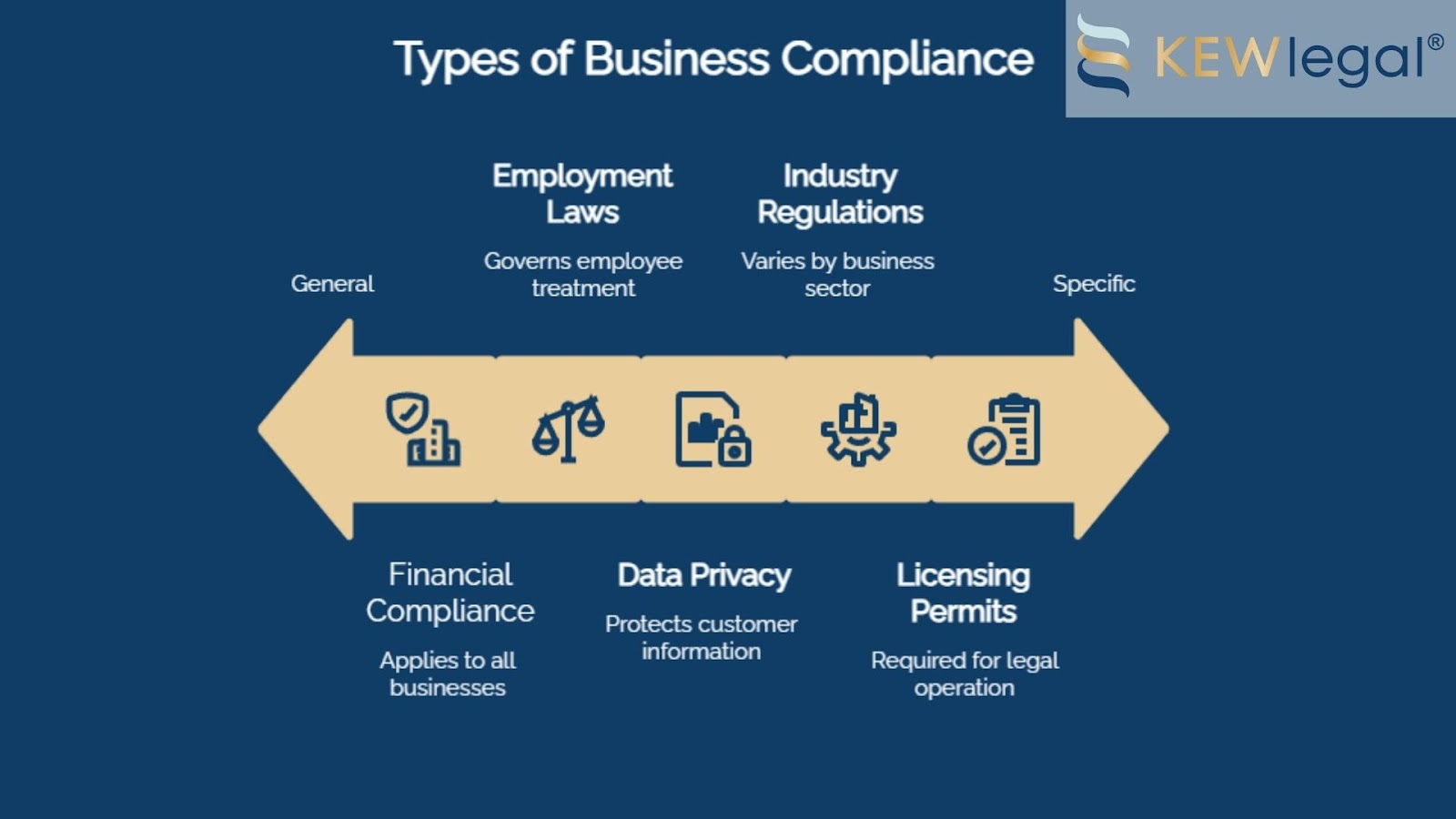

Key Types of Business Compliance

Business compliance can take many forms depending on the nature of your operations. The most common categories include financial protocols, labor law adherence, data security, industry-specific rules, and licensing. Here’s how each area impacts your business:

Financial Compliance

This includes accurate bookkeeping, timely tax filing, and meeting financial disclosure regulations.

Employment and Labor Laws

These govern fair pay, discrimination, health and safety, and the proper classification of employees versus contractors.

Data Privacy and Cybersecurity

With GDPR and local laws like CCPA, protecting customer data is a legal requirement. In high-risk industries like pharma, breaches cost millions on average.

Industry-Specific Regulations

Businesses in healthcare, construction, and finance must follow distinct compliance frameworks such as HIPAA, OSHA, or SOX.

Licensing and Permits

Failure to renew or properly apply for required licenses can halt operations instantly.

4 Common Risks of Noncompliance

- Legal penalties: Fines reached billions globally in 2024.

- Operational disruptions: Audits or investigations can freeze business functions.

- Reputational harm: Loss of trust from partners and consumers.

- Personal liability: Owners and executives can be held accountable.

How to Build a Compliance Framework That Works

A structured compliance framework keeps your business running smoothly and protects your reputation. Key components include designated oversight, regular reviews, internal policies, staying informed, and leveraging automation:

Appoint a Compliance Lead

This can be an in-house employee, an outsourced general counsel, or dedicated manager, depending on business size.

Conduct Regular Audits

Routine checks confirm that policies match evolving laws and flag gaps before they become liabilities.

Develop Internal Policies and Training

Training staff on processes and expected behavior reduces legal exposure and creates a culture of accountability.

Stay Current on Legal Updates

Subscribe to alerts from government agencies and industry publications.

Use Compliance Tools

Software can automate license tracking, document storage, audit preparation, and deadline alerts.

How KEW Legal® Helps Businesses Stay Confidently Compliant

General counsel services from KEW Legal® are built for business owners who need business-smart strategy. Our approach integrates directly into your operations, helping you identify compliance gaps before they become liabilities.

We become part of your extended team. That means you get ongoing legal guidance, fast answers, and practical support that aligns with your day-to-day decisions. Our general counsel model allows for consistency, clarity, and confidence across your legal landscape.

KEW Legal® helps you stay ahead of compliance requirements without slowing down your momentum.

Let’s Simplify Compliance Together

If compliance feels complicated or risky, you’re not alone. But you don’t have to go through it without help. At KEW Legal®, we offer clear, real-world legal guidance designed around your business, not generic templates. We’re here to protect what you’re building and make legal support feel like a smart business move, not a burden.

Ready for confident compliance? Contact KEW Legal® to get personalized legal support today.