If you’re buying a business or planning a merger, knowing exactly what you’re dealing with helps you avoid costly mistakes.

Due diligence helps you spot hidden problems before they become your problems, especially since, according to Harvard Business Review, between 70% and 90% of mergers and acquisitions fail to meet their intended financial objectives.

At KEW Legal®, we’ve seen firsthand how clear, practical legal guidance makes all the difference. Unlike firms that overload you with overly cautious advice, we believe in straightforward answers, helping you quickly spot risks so you can confidently close the right deals.

Key Takeaways

- Due diligence helps you spot hidden risks before closing any business deal.

- Different deals require different types of diligence, financial, legal, operational, and more.

- Skipping key diligence steps like IP or customer checks can cost you later.

1. Financial Due Diligence

Financial due diligence checks whether a company’s numbers are real, stable, and sustainable. You review revenue, profits, debts, cash flow, and accounting practices to catch red flags before closing a deal.

Focus on:

- Revenue trends (monthly, yearly, seasonality)

- Customer concentration (how much revenue depends on a few accounts)

- Profit margins and cost breakdowns

- Debt structure and repayment terms

- Cash flow reliability, can they operate without constant new funding?

- One-time vs. recurring income

If half the revenue relies on a single customer, that’s a major risk. If profit is dependent on delayed payments, your cash flow might quickly dry up.

2. Legal Due Diligence

Legal due diligence uncovers risks in contracts, ownership, lawsuits, and regulatory issues. You’re checking whether the company legally owns what it claims and if any liabilities could follow the deal.

Review:

- Key contracts like vendors, customers, leases, employment agreements

- Intellectual property like patents, trademarks, copyrights

- Ongoing or past litigation

- Regulatory filings and licenses

- Legal structure and corporate governance

- Data privacy and compliance (especially in tech, healthcare, or finance)

Focus on deal-breakers, expired IP filings, missing NDAs, or termination clauses that kick in at acquisition. A missed lawsuit or non-compete clause can derail a deal or spark post-close problems.

Use in-house counsel or outside lawyers who know the industry. For startups, look closely at IP ownership.

3. Operational Due Diligence

Operational due diligence looks at how the business runs day to day, and whether it can scale, integrate, or even survive post-acquisition. It’s about systems, workflows, supply chains, and execution risk.

Assess:

- Core processes: sales, support, fulfillment, logistics

- Key suppliers and vendor dependencies

- SOPs, documentation, and training

- Scalability of operations and infrastructure

- Gaps or single points of failure

If the business depends on one person who handles everything, that’s a risk. If no systems are documented, integration will be messy.

This type of due diligence tells you if the company’s operations can handle growth, or if they’ll collapse under pressure. It also helps spot hidden costs like inefficient workflows or vendor lock-in.

4. Commercial Due Diligence

Commercial due diligence checks if the business can actually compete. It looks at the market, customers, and how the company earns (and keeps) its place.

Focus on:

- Market size, trends, and saturation

- Competitive positioning

- Customer base and retention rates

- Sales pipeline quality and forecasts

- Product-market fit and pricing model

You’re validating that the growth story makes sense. Strong revenue doesn’t mean much if the market is shrinking or if a competitor is about to launch a better product.

Talk to customers, review churn data, analyze NPS scores, and look at how repeatable the sales process is. Forecasts should be backed by evidence, not just founder optimism.

5. Tax Due Diligence

Tax due diligence finds hidden tax liabilities that could hit after closing. You’re checking if the company has paid what it owes, and if any audits, penalties, or misclassifications are lurking.

Review:

- Federal, state, and local tax filings (income, sales, payroll)

- Past audits and outcomes

- Nexus issues (especially for remote or multi-state operations)

- Employee classifications (W-2 vs. contractor)

- Deferred tax assets or liabilities

- International tax structure if cross-border

Even small companies can have major issues, like unpaid sales tax in the wrong state, or misreporting R&D credits. These become your problem after the deal closes.

Bring in tax advisors or accountants familiar with M&A. They’ll know where to look and what’s common in your target’s industry.

6. IT Due Diligence

IT due diligence checks if the company’s technology is reliable, secure, and scalable.

Review:

- Core systems (CRM, ERP, billing, support tools)

- Custom code, integrations, and third-party tools

- Data security practices and policies

- Infrastructure setup, cloud, on-prem, hybrid

- Tech debt and system documentation

- Past breaches or incidents

You’re looking for risks like outdated systems, unsupported tools, weak security, or critical reliance on a single developer. Post-close headaches are guaranteed if the tech can’t scale or isn’t secure.

Pull in your IT lead or an external tech auditor. In SaaS deals, check code quality, documentation, and compliance (like SOC 2 or GDPR).

7. HR Due Diligence

HR due diligence uncovers risks tied to people, contracts, culture, compensation, and compliance. It helps you understand how the workforce will affect the deal after it closes.

Check:

- Employee contracts, offer letters, and non-competes

- Compensation, bonuses, and equity agreements

- Benefits plans and liabilities (e.g., unused PTO, pensions)

- Key personnel and retention risks

- Pending HR issues (claims, disputes, morale problems)

- Organizational structure and headcount breakdown

A great product can still fail if the team walks out after the acquisition. Unclear equity terms, weak retention plans, or expensive legacy benefits can drag down value fast.

Work with HR and legal to confirm obligations and spot people-related red flags. In acqui-hires, focus on retention terms. In larger deals, check for bloated org charts or misaligned incentives.

8. Environmental Due Diligence

Environmental due diligence checks for liabilities tied to real estate, operations, or industry regulations. It’s important in deals involving physical assets, manufacturing, or land use.

Review:

- Site contamination risks (soil, water, air)

- Past environmental audits or violations

- Compliance with local, state, and federal laws

- Hazardous materials handling and disposal

- Required permits or environmental licenses

- Cleanup responsibilities from prior owners

If there’s a leak, a violation, or an unresolved EPA issue, you could be on the hook, even if it happened before your deal. Cleanups can cost millions and trigger legal fallout.

9. Regulatory and Compliance Due Diligence

Regulatory due diligence confirms the company complies with industry-specific laws, licenses, and reporting requirements. It’s a must in sectors like healthcare, finance, education, and anything government-regulated.

Focus on:

- Required licenses, certifications, and registrations

- History of violations, fines, or compliance gaps

- Reporting obligations (HIPAA, PCI, FINRA, GDPR, etc.)

- Internal compliance policies and enforcement

- Risk of regulatory scrutiny post-acquisition

Missing one permit or misclassifying data privacy requirements can trigger investigations, delays, or even kill the deal. In cross-border deals, check both local and international rules.

10. Strategic Due Diligence

Strategic due diligence evaluates whether the deal aligns with your company’s long-term goals.

Assess:

- Strategic fit with your products, market, or roadmap

- Synergy opportunities, cost savings, cross-sells, tech integration

- Culture and vision alignment

- Deal timing and market positioning

- Potential for long-term value creation

Even if the numbers look good, the deal can fall flat if the target pulls your focus away from core strategy or adds complexity you can’t manage.

This is often led by senior leadership or strategy teams. It’s where you ask: will this deal move the business forward, or just make it bigger?

11. Cultural Due Diligence

Cultural due diligence examines how people work, communicate, and make decisions. Even if the strategic fit seems perfect, culture clashes can quickly derail integration efforts and cause key talent to leave.

Look into:

- Leadership styles and decision-making structures

- Core values and communication norms

- Team dynamics and employee sentiment

- Workplace policies (remote vs. in-office, flexibility, hierarchy)

- History of turnover or internal conflict

This lets you assess whether the employees can work together without friction. Clues show up in onboarding processes, meeting styles, or how teams handle feedback.

Interview team leads. Read internal docs. Review engagement scores if available. Cultural alignment is tough to fix post-close, spot problems early.

12. Intellectual Property (IP) Due Diligence

IP due diligence verifies ownership and protection of the company’s intellectual property, code, trademarks, patents, data, and creative assets. It’s critical in tech, media, and product-driven businesses.

Check:

- Patents, trademarks, copyrights, status and expiration

- IP assignments from founders, contractors, and employees

- Licensing agreements and third-party usage rights

- Open-source software use and compliance

- Pending IP disputes or infringement risks

A missing assignment agreement or misused open-source license can stall or kill a deal. If the company doesn’t fully own its core product, that’s a serious liability.

Involve IP lawyers and software auditors early, especially in SaaS or hardware acquisitions.

13. Customer Due Diligence

Customer due diligence looks at who the company serves, how strong those relationships are, and what risks come with them. It helps you understand revenue quality, not just quantity.

Review:

- Customer concentration (how much revenue comes from top accounts)

- Contract terms, renewal dates, and cancellation clauses

- Churn rates and retention metrics

- Customer satisfaction (NPS, reviews, support history)

- Outstanding disputes or credit issues

If 60% of revenue comes from two clients, that’s fragile. If key contracts are up for renewal, dig into renewal likelihood and terms. Weak customer relationships can unravel projected growth fast.

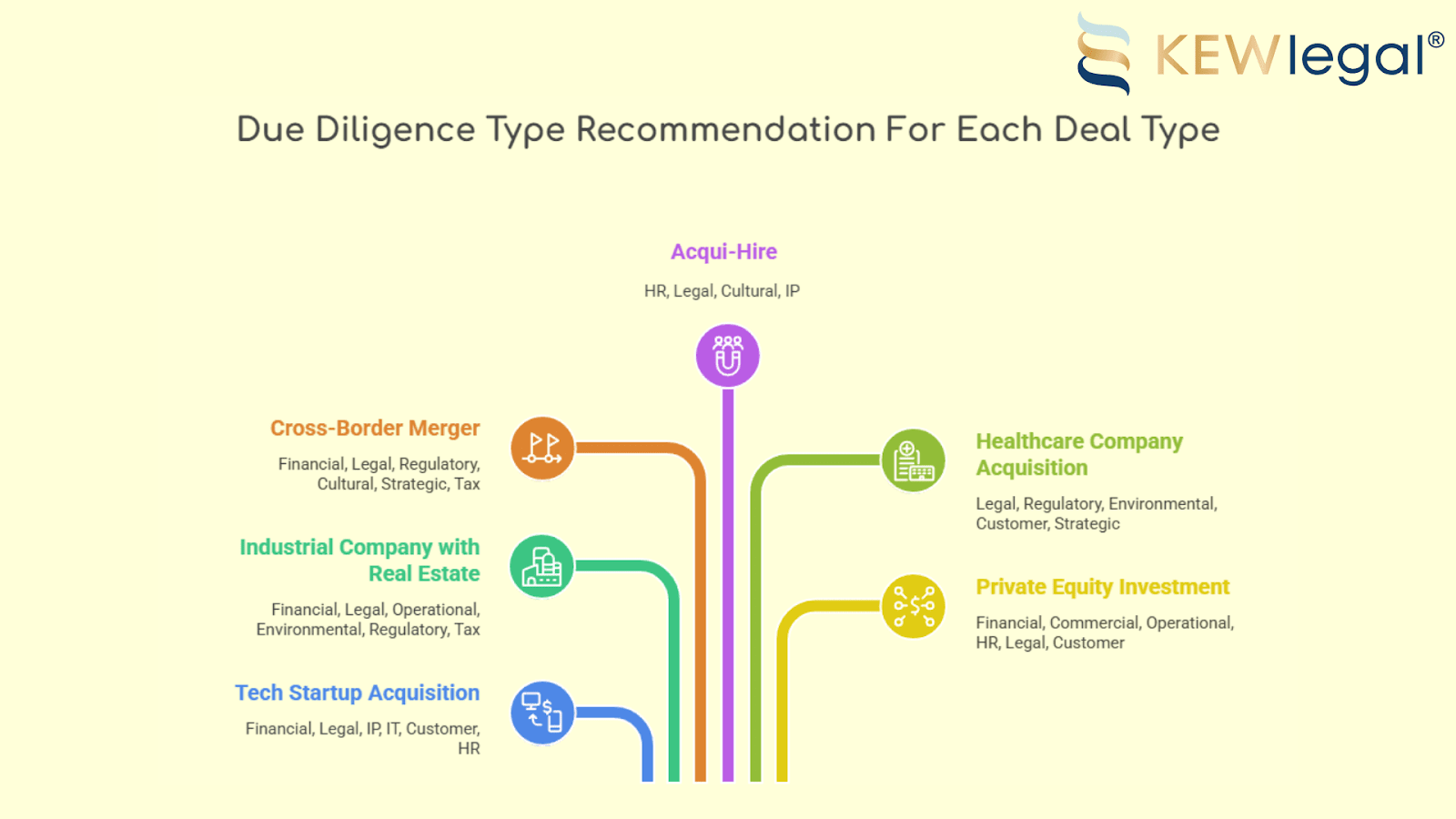

When to Use Each Type of Due Diligence

Not every deal needs all 13 types. What matters is the context, industry, deal size, structure, and risk. Use this as a guide to focus your time and resources where they count.

| Deal Scenario | Recommended Due Diligence Types |

| Tech startup acquisition | Financial, Legal, IP, IT, Customer, HR |

| Industrial company with real estate | Financial, Legal, Operational, Environmental, Regulatory, Tax |

| Cross-border merger | Financial, Legal, Regulatory, Cultural, Strategic, Tax |

| Acqui-hire (team-focused deal) | HR, Legal, Cultural, IP |

| Healthcare company acquisition | Legal, Regulatory, Environmental, Customer, Strategic |

| Private equity investment | Financial, Commercial, Operational, HR, Legal, Customer |

Use this guide to plan your diligence process upfront. If you’re short on time or resources, start with core risk areas, usually financial, legal, and operational, then expand based on red flags.

Common Mistakes to Avoid

Even experienced teams miss things. These are the mistakes that come back to bite after the deal closes.

- Assuming financials are enough

Just because the revenue looks good doesn’t mean the tech, culture, or customer base will hold up. - Skipping IP verification

If the company doesn’t fully own its product or code, you may not either. - Overlooking customer concentration

A single high-paying client walking away can tank post-close revenue. - Ignoring integration risks

Poor operational fit or culture clashes can stall growth or trigger key team exits. - Not checking compliance details

Missing a required license or violating data laws can lead to fines or a deal reversal. - Using generic checklists

Due diligence isn’t one-size-fits-all. Customize based on deal type, industry, and red flags.

Get Clear, Practical Help with Your Due Diligence

Knowing the right questions to ask is key, but having a trusted partner who helps you find answers quickly makes all the difference. At KEW Legal®, we focus on clear, actionable advice, so you spend less time worrying and more time making confident decisions.

Ready to move your deal forward with clarity and confidence? Contact us today and see how our practical, client-focused approach can support your next step.